9 Simple Techniques For Matthew J. Previte Cpa Pc

9 Simple Techniques For Matthew J. Previte Cpa Pc

Blog Article

All about Matthew J. Previte Cpa Pc

Table of Contents3 Simple Techniques For Matthew J. Previte Cpa PcThe Ultimate Guide To Matthew J. Previte Cpa PcThe Ultimate Guide To Matthew J. Previte Cpa PcOur Matthew J. Previte Cpa Pc DiariesFascination About Matthew J. Previte Cpa PcThe 15-Second Trick For Matthew J. Previte Cpa Pc

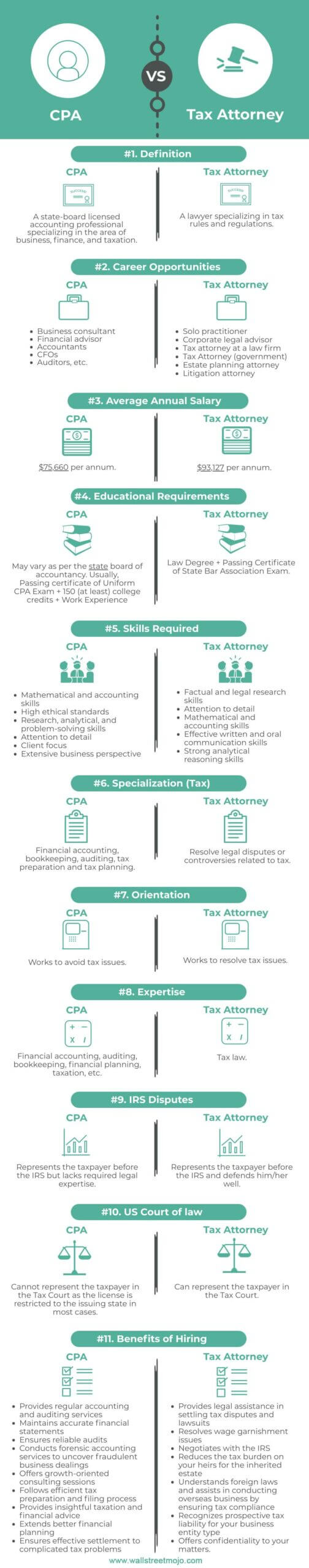

Even in the simplest economic circumstance, filing state and/or federal tax obligations can be a difficult annual job. When it comes to navigating complicated tax issues, though, this complicated process can be downright daunting to deal with by yourself. No matter your income, deductions, family demographics, or occupation, working with a tax obligation lawyer can be valuable.And also, a tax attorney can speak to the IRS in your place, saving you time, energy, and frustration (tax lawyer in Framingham, Massachusetts). Allow's speak about what a tax obligation attorney does and that ought to take into consideration collaborating with one. A tax obligation lawyer is a kind of lawyer who focuses on tax obligation laws and procedures. Just like the majority of regulation professions, tax attorneys frequently focus on a specific tax-related area.

7 Easy Facts About Matthew J. Previte Cpa Pc Shown

If you can not satisfy that financial debt in time, you might even encounter criminal fees. For this reason, outstanding tax debt is a terrific reason to work with a tax relief lawyer.

A tax lawyer can additionally represent you if you pick to deal with the IRS or assist create a method for paying off or working out the shortage - Due Process Hearings in Framingham, Massachusetts. A tax lawyer can supply support, aid you figure out just how much your organization can expect to pay in tax obligations, and suggest you of approaches for minimizing your tax burden, which can assist you avoid expensive blunders and unexpected tax obligation expenses while taking advantage of specific regulations and tax obligation rules.

Choosing a tax attorney need to be done very carefully. Here are some means to boost your opportunities of locating the right individual for the task: Before working with a tax obligation attorney, recognizing what you require that attorney to do is important. Are you wanting to minimize your small company's tax burden every year or create a tax-advantaged estate prepare for your family? Or do you owe a considerable financial debt to the internal revenue service yet can not pay? You'll desire a tax attorney that concentrates on your particular field of demand.

Some Ideas on Matthew J. Previte Cpa Pc You Should Know

Some tax alleviation agencies supply bundles that give tax solutions at a flat rate. Various other tax obligation lawyers may bill by the hour.

With tax obligation lawyers who bill hourly, you can anticipate to pay between $200 and $400 per hour usually - https://www.kickstarter.com/profile/taxproblemsrus1/about. Your last price will certainly be figured out by the intricacy of your situation, exactly how swiftly it is minimized, and whether continued solutions are needed. For circumstances, a standard tax audit may run you around $2,000 on standard, while completing an Offer in Concession may cost closer to $6,500.

Matthew J. Previte Cpa Pc Can Be Fun For Anyone

The majority of the moment, taxpayers can manage individual income taxes without too much problem yet there are times when a tax attorney can be either a useful resource or a required companion. Both the IRS and the California Franchise Business Tax Board (FTB) can get quite hostile when the guidelines are not adhered to, also when taxpayers are doing their best.

Both federal government companies administer the income tax code; the IRS manages government tax obligations and the Franchise business Tax obligation Board manages California state tax obligations. Federal Tax Liens in Framingham, Massachusetts. Because it has fewer sources, the FTB will piggyback off click over here results of an IRS audit however concentrate on areas where the margin of taxpayer mistake is greater: Deals including funding gains and losses 1031 exchanges Past that, the FTB tends to be more aggressive in its collection tactics

Not known Incorrect Statements About Matthew J. Previte Cpa Pc

Your tax obligation attorney can not be asked to affirm versus you in legal proceedings. A tax obligation attorney has the experience to accomplish a tax settlement, not something the person on the street does every day.

A certified public accountant may know with a couple of programs and, even then, will certainly not necessarily understand all the provisions of each program. Tax code and tax legislations are intricate and usually change every year. If you remain in the IRS or FTB collections process, the incorrect guidance can cost you dearly.

All About Matthew J. Previte Cpa Pc

A tax obligation lawyer can additionally aid you locate means to lower your tax bill in the future. If you owe over $100,000 to the IRS, your case can be placed in the Big Buck Unit for collection. This unit has the most skilled agents benefiting it; they are aggressive and they close instances quick.

If you have possible criminal concerns coming right into the examination, you absolutely want a lawyer. The internal revenue service is not recognized for being extremely responsive to taxpayers unless those taxpayers have cash to hand over. If the internal revenue service or FTB are disregarding your letters, a tax obligation lawyer can prepare a letter that will get their focus.

Report this page